Piyumal: on the road to streamlining legacy operations with Atoti

The Atoti community is full of individuals who use Atoti in new and exciting ways to solve day-to-day business problems. One member of our community who stood out to me was Piyumal W.

In his Atoti self-learning journey, I had the opportunity to chat with him while supporting the Atoti community. That’s when I got to know more about how he had used data analytics to optimize business operations in his project. Read on to find out more about how Atoti sped up the process!

Huifang: Tell us a bit about yourself.

Piyumal: My background is in Quantitative Analytics. I have worked in credit risk modeling and Institutional portfolio management for multinational Australian and UK banks.

Huifang: Walk us through the current project you’re working on.

Piyumal: The project centers around a logistic company I’m a part of. This logistic company is a consolidation of multiple subsidiaries that operate as business partners for multinational commercial food manufacturers.

The company had a legacy of manual processes embedded into its day-to-day operations. This partial technology approach to operations led to significant pitfalls in its processes. Especially within its oversight and reconciliation efforts.

As such, when something went wrong, it would only surface long after the incident or worse yet, never surface at all.

There was a significant disjoint between the operational and financial performance of the firm. Management is led by experience and judgment. Therefore, it gives no leeway for the optimization of operational efficiencies that are needed for a better financial performance.

Huifang: How are you using Atoti for this project?

Piyumal: There are multiple platforms that manage the day-to-day BAU (business as usual). However, the three core strategy systems are as follows:

- Credit Management and operational performance

- Automated Supply chain optimization.

- Financial Performance.

I custom-developed the first two systems for the unique use case of the business.

Atoti assists in the visualization of all financial performance metrics. It allows us to have a centralized overview of multiple business units and channels. We are also able to understand credit risk in more detail.

Moreover, in its end state, we expect Atoti will help us in understanding how to manage the portfolio, and manipulate levers to better service our customers. This can be achieved by understanding dynamics at the most granular level that contributes to our RoE (Return on equity) framework.

Huifang: Why was this project important to you?

Piyumal: This project ensures that this business can be migrated to the digital world. Business optimization will then be possible, and consequently, allows management to make more informed decisions using data analytics. Eventually, these will contribute to the longevity of the business and the people who depend on it.

Most of the employees have been with the business for more than 15 years on average. They have invested a majority of their career in the betterment of this company. On top of that, they have also bet their livelihood and their families’ livelihoods on this business.

Therefore, I feel that as a member of the executive management team, it is paramount that we find better ways to ensure the sustainability of this business well into the future.

Huifang: Did you hit any speed bumps along the way?

Piyumal: Yes, multiple. However, the biggest challenge was a lack of organization in the methodology used to feed information into the digital environment. Things were done haphazardly and consistency was lacking.

Before beginning to dive into any digital nuances, it was paramount that consistent operational processes were embedded and accountability established with frontend staff.

It was very important to understand how to integrate financial performance into operational performance. We can achieve this by embedding well-defined processes into the day-to-day operations. For example, there were instances when human error led to a loading shortage in the fleet distribution. This resulted in a secondary vehicle needing to make another trip to service a single client. A single trivial error at the beginning of the process led to additional fuel costs, wear and tear in vehicles, as well as human resources.

Another example within the credit domain includes internal fraud. A courtesy credit period is given to each client for payment to be made. A client may have made timely payment for the goods received. The collections associate, however, might hold on to the paid sum until the credit period concludes. He profiteered through personal loan advances of this payment to his associates. This is all at the cost of the client’s creditworthiness and the company balance sheet.

Huifang: How did you overcome these problems?

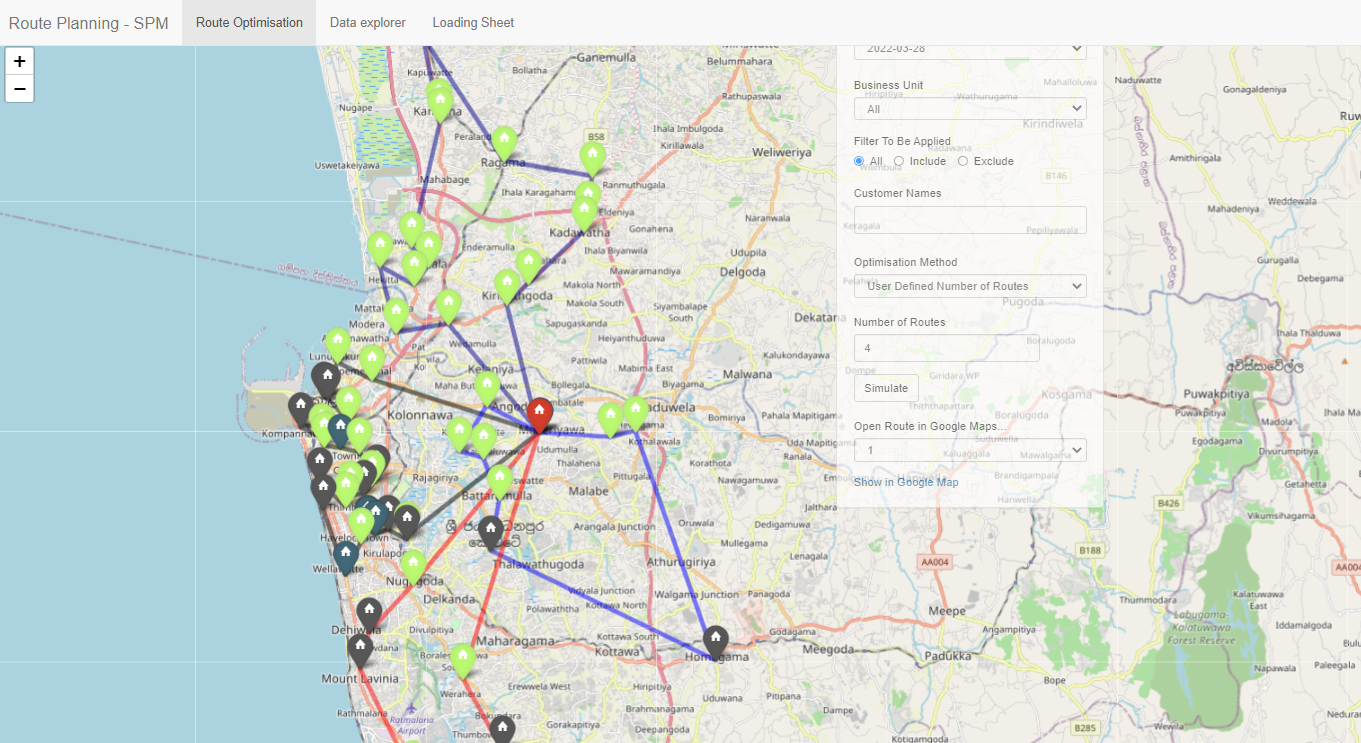

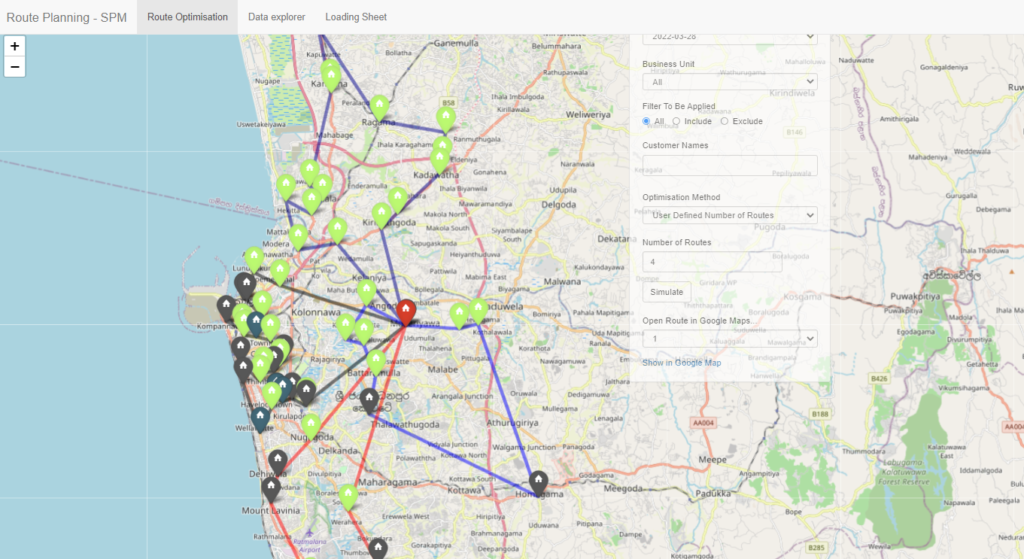

Piyumal: We developed in-house technology solutions to systematically address the issues mentioned in the two examples above. Firstly, route optimization and load allocation systems embedded more efficiency and controls in the delivery process. Secondly, credit management and payment pattern recognition systems assisted in isolating extremities for further fraud investigations.

Given the above strategic solutions, it laid the required foundation to dive deeper in search of ways to better the business’s financial performance.

Huifang: How did Atoti benefit your project?

Piyumal: With Atoti, I can slice, visualize, and conclude in a timely manner in all ways I felt were pertinent to my problem. Moreover, as I further get up to scratch with Atoti, I envisage Atoti allowing me to embed more forward-looking capabilities. This will allow the business to strategically position itself in ever-changing market dynamics.

Huifang: How did you discover Atoti?

Piyumal: I discovered Atoti on a LinkedIn post that a connection of mine had posted.

Huifang: Why did you choose to work with Atoti?

Piyumal: With Atoti, I was able to use python to control NOT just the data feed, but the data cube and its intricacies. By executing a single piece of code, I could see the results appear on the front end. This took away a huge part of my workflow in prototyping different forms of data analytics, in order to get the pertinent message to the end-user.

In a nutshell, it reduced the time it took from inception to output.

Huifang: Which Atoti feature do you find most useful for your work?

Piyumal: I love the drag-and-drop feature and the ability to flick through multiple forms of visualizations in the span of a few seconds. However, whilst that is a great feature, the most important thing for me is to be able to programmatically construct visualizations. I am able to derive metrics across multiple tiers of information and push them into production with no lag time.

Huifang: Do you have plans to expand your project?

Piyumal: Yes, with data simulation!

We hope to use Atoti to simulate different scenarios and to understand how these scenarios will impact our balance sheet.

As Piyumal has shared, a data analytics project is not just about deriving metrics and visualizations. It also depends on the ability to:

- be in control of your code

- to quickly and effectively communicate with your stakeholders

- minimize the time from inception to production for data analytics projects

Atoti is a collaborative platform for BI analytics. With one tool, you’ll be able to perform aggregation, visualization, dashboarding and much more. Try it yourself, and share with us your experience.