Manage and analyze large amounts of transactions and historical data

Interest Rate Risk in the Banking Book (IRRBB) is the risk of adverse effect on a bank’s capital and earnings by interest rate movements in the market. Interest rate changes can affect the value and timing of future cash flows as well as the present values of assets, liabilities and off-balance sheet items of the bank.

Under the Basel Framework, IRRBB is captured in Pillar 2, supervisory review. It ensures banks have adequate capital and liquidity to support all business risk and encourages good risk management.

The Australian regulator Australian Prudential Regulation Authority (APRA) has released the Prudential Standards (APS117) to set out requirements for how banks measure IRRBB and the regulatory capital requirements. In November 2022, APRA released the draft version of the APS117 standards. We are anticipating the final release of the standard in 2023 and effective by January 2025.

Prudential Standard APS 117

The key requirements of this Prudential Standard are that banks must:

- have a framework to manage, measure and monitor interest rate risk in the banking book, commensurate with the nature, scale and complexity of its operations; and

- be approved by APRA to use an internal model for determining its interest rate risk in the banking book capital charge.

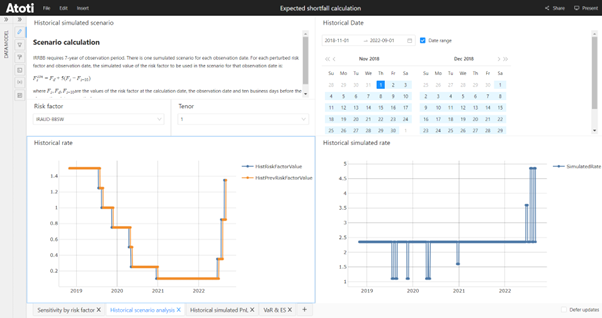

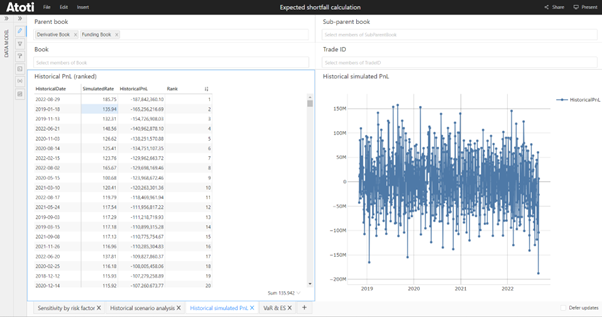

The APS 117 internal model is like Traded Market Risk or Fundamental Review of Trading Book (FRTB) calculations. It requires the expected shortfalls calculation from the simulated P&Ls with the historical rate movements. The challenge in this calculation is to manage the large amount of transaction data as well as the historical rate data (7 years history and 1-year stress period) on top of the convoluted mappings of accounts and cash flows assumptions.

With Atoti, we can calculate the IRRBB capital charge quickly. In addition, we can perform our analysis up to the transactional data level. Furthermore, Atoti enables Risk Management teams to consolidate operations and calculations in a centralized platform. By and large, Atoti helps banks reduce their infrastructure footprints.

Atoti Notebook

Lastly, check out the IRRBB use case in the Atoti notebook gallery. The notebook follows the latest APS 117 draft standards. It demonstrates the calculation by adopting the approved IRRBB model specified in Attachment B.

Reference

- Basel Framework SRP31: https://www.bis.org/basel_framework/chapter/SRP/31.htm

- APRA, APS 117 Standards, November 2022: https://www.apra.gov.au/sites/default/files/2022-11/Prudential Standard APS 117 Capital Adequacy – Interest Rate Risk in the Banking Book – clean.pdf